The Psychology of Money by Morgan Housel delves into the way people think about money and the emotional, psychological factors that drive financial decision-making. Rather than focusing on complex financial theories, it emphasizes that managing money is not just a matter of knowledge, but deeply rooted in human behavior and psychology. Through stories and real-life examples, the book illustrates that financial success is more about how we behave than what we know.

Need help? Call us:

+1 1800 212 3434

Shopping cart (1)

Subtotal: $2.00

Spend $3,048.00 to get free shipping

Congratulations! You've got free shipping.

Menu

Categories

- Personal Success

- Anxiety Disorders

- U.S. History

- Magical Realism

- Faith and Belief

- Psychology

- Technology

- Poetry

- Mental Health

- Current Affairs

- Non-Fiction

- Language Arts

- Education

- Web Development

- Romance & Love Stories

- Personal Growth

- Personal Finance

- Speculative History

- Communication Skills

- Islamic Studies

- Family Saga

- Science & Technology

- Religion

- Wealth Management

- Entrepreneurship

- Personal Development

- Biographies

- Political Science

- Inspirational

- Self-Help

- Writing

- Investment Strategy

- Fantasy

- Mystery & Thrillers

- Children’s Book

- Art Instruction

- Autobiography

- Business

- Career Management

- Politics

- Spirituality

- Literature

- Comics

- Drawing & Sketching

- Political Memoir

- Ancient History

- Indian Literature

- Middle Eastern Studies

- Time Management

- Domestic Drama

- Cookbook

- Visual Arts

- Lifestyle

- Philosophy

- Drama

- Sports

- Music

- Finance

- History

- Leadership Skills

- Social Science

- Linguistics

- Political Fiction

- Leadership

- Cultural Studies

- Investment

- Motivation

- Teacher Training

- Safety

- Philosoph

- Religion & Spirituality

- Parenting

- Language Learning

- Trading

- Novel

- Teaching Methods

- Nonfiction

- Fiction

- Comparative Religion

- Family & Relationships

- Dictionaries

- Risk Management

“The Obstacle Is the Way” has been added to your cart. View cart

$5.00 Original price was: $5.00.$0.99Current price is: $0.99.

First Add your favorite books calculated at checkout.

The Psychology of Money

Author:

The Psychology of Money by Morgan Housel explores how psychological factors and human behavior impact financial decisions and outcomes.

8 people are viewing this product right now

Tags: business, Finance, Money, Personal Finance, Psychology, Self Help

Categories: Motivation, Self-Help

Have any Questions?

Feel free to Get in touch

Print Length

253

Format

- Emotions and Money: People's financial decisions are heavily influenced by emotions like fear, greed, and ego. Learning to manage these emotions is key to long-term financial stability.

- Wealth vs. Riches: There is a difference between being wealthy and being rich. Wealth is what you don’t see—it's the ability to save and invest for the future, while riches are the visible signs of money.

- Luck and Risk: Luck plays a significant role in financial success, but it's often underappreciated. Similarly, risk is unavoidable, and understanding your risk tolerance is essential for making smart financial choices.

- Power of Compounding: Long-term thinking and patience allow compound interest to work in your favor. Starting early and letting money grow slowly over time is more effective than chasing quick gains.

- Individual Perspectives: People make financial decisions based on their own experiences and backgrounds, which means there's no universal approach to managing money that fits everyone.

- Living Below Your Means: Frugality and saving are more important than trying to constantly increase income. Living below your means provides freedom and security.

- The Importance of Flexibility: The future is unpredictable, and building flexibility into your financial plans allows you to adjust as circumstances change.

- "Wealth is what you don’t see."

- This quote emphasizes that true wealth is often hidden from view and not always apparent from outward appearances.

- "The ability to save money is more important than the ability to make money."

- Housel suggests that saving money and managing it wisely is more crucial for financial success than simply earning a high income.

- "The more you learn about money, the more you realize that you don’t know anything about money."

- This reflects the idea that financial literacy is an ongoing journey, and as you learn more, you become more aware of how much there is still to understand.

- "Wealth is not about having a lot of money; it’s about having a lot of options."

- This highlights that financial security is more about having the freedom and flexibility to make choices rather than just accumulating wealth.

- "The greatest enemy of good investing is not the market, it’s the investor."

- Housel points out that individual behavior and decisions often pose a greater risk to investment success than market fluctuations.

- How does the way we view wealth and money affect our financial decisions?

- This question explores the psychological impact of how we perceive wealth and its influence on our financial behavior.

- What role does behavior play in financial success, and how can we improve our financial habits?

- Understanding how behavior impacts financial outcomes can lead to better strategies for saving and investing.

- In what ways does financial knowledge or the lack thereof shape our financial outcomes?

- This question addresses the importance of continuous learning and its impact on our financial decisions.

- How can having more options or freedom affect our sense of financial security?

- This explores the relationship between financial flexibility and overall well-being.

- What are some common mistakes investors make, and how can they be avoided?

- Identifying common pitfalls in investing can help in developing strategies to avoid them and achieve better financial results.

Be the first to review “The Psychology of Money” Cancel reply

Related products

Sale!

Atomic Habits: An Easy & Proven Way to Build Good

Sale!

How To Win Friends and Influence People

Sale!

The Richest Man in Babylon

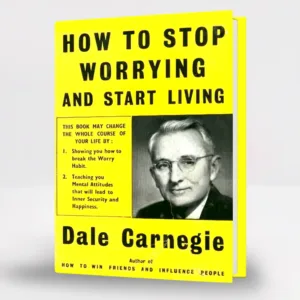

Sale!

How To Stop Worrying And Start Living

You may add any content here from XStore Control Panel->Sales booster->Request a quote->Ask a question notification

At sem a enim eu vulputate nullam convallis Iaculis vitae odio faucibus adipiscing urna.

Reviews

There are no reviews yet.